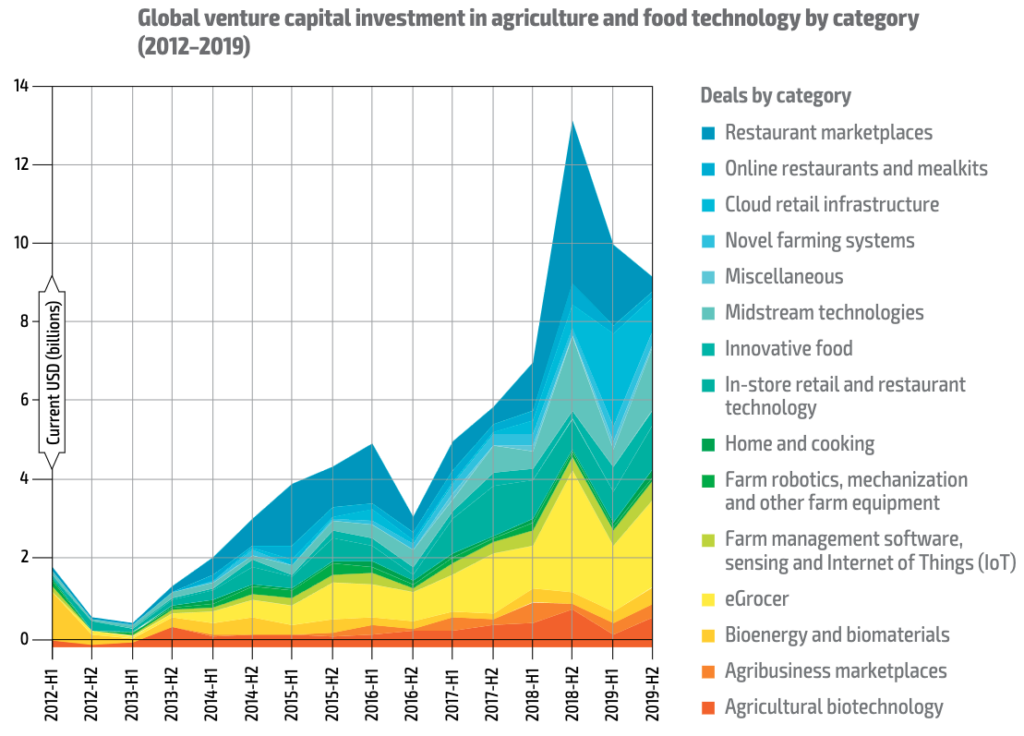

Technology, including automation, data analytics, and biotechnology, has a significant impact on food production and distribution. Advancements in technology, such as automation, digitisation, biotechnology, AI, big data, Internet of Things (IoT), cellular agriculture etc. revolutionise food production efficiency, supply chain management, and consumer engagement, reshaping the structure and operation of the food system. However, the future trajectory of technological adoption remains uncertain, influenced by factors such as investment, consumer behaviours, capacity building, and policy support. Venture capital investments in agriculture and food technology offer insights into historical trends but cannot fully predict future innovation. In scenario studies, many assumptions have been made about how technology may play a major role in food systems transformation.

This section presents selected data on key trends in technology:

- Digitisation

- Big Data

- Artificial Intelligence (AI)

- Synthetic Biology

- Agronomic innovation

1. Digitisation

Trends and projections

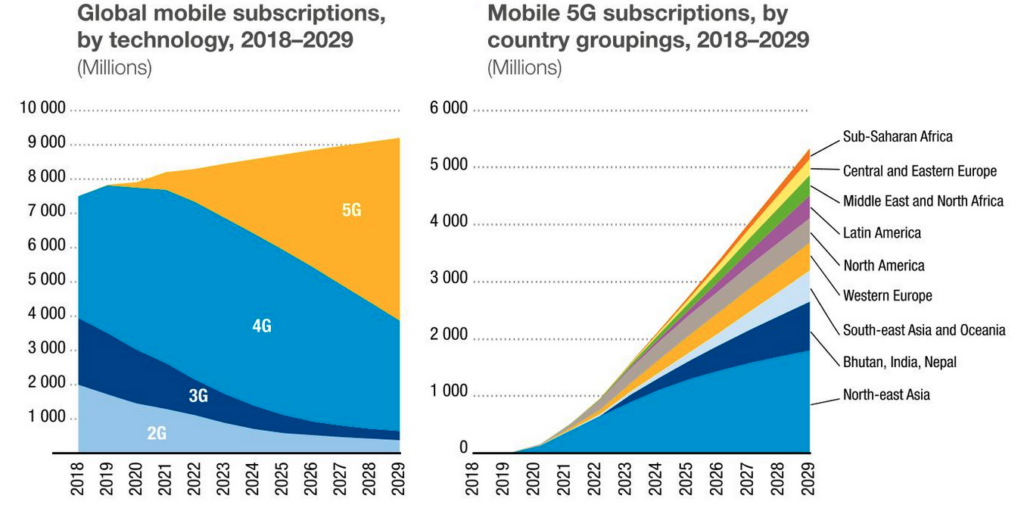

The volume of global data traffic is forecast to grow by a factor of 2.5 by 2029. Much of this growth will be attributed to the improvements in mobile technologies. Access to 5G technology is expected to grow significantly in the near future, with global population coverage from 45% in 2023 to 85% in 2029 (UNCTAD, 2024). In low-income countries, mobile phone subscriber penetration stands at almost 60 percent and is expected to grow rapidly. The farmer field schools approach has spread to more than 90 countries and has been used to train an estimated 20 million farmers (FAO, 2017).

Implications

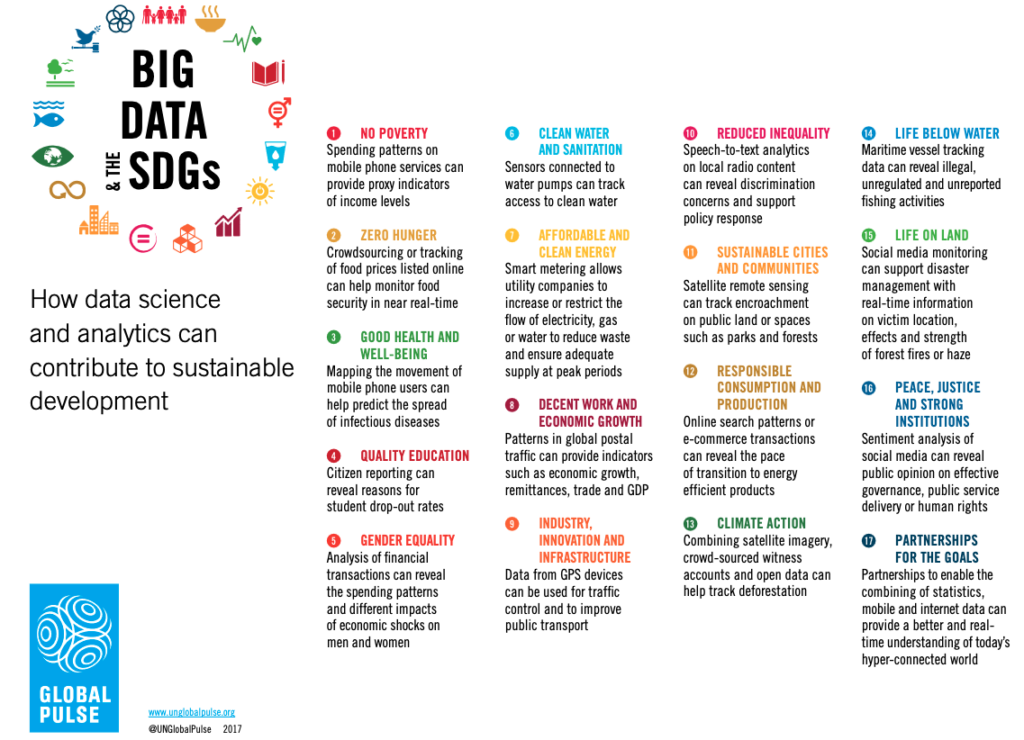

Digital advances are supporting and accelerating the achievement of each of the 17 Sustainable Development Goals which also constitutes food systems outcomes. Information and communications technologies are playing an increasingly important role in keeping farmers and rural entrepreneurs informed about agricultural innovations, weather conditions, input availability, financial services and market prices, and connecting them with buyers. It also supports the automation of the food value chain. Many Industry 4.0 technologies such as Artificial Intelligence (AI), Internet of Things (IoT), Big Data (BD), blockchain, robotics, and smart sensors are being employed by the whole food supply chain from farm to fork (Hassoun et al. 2022).

But technologies can also threaten privacy, erode security and fuel inequality. Increased digitisation also requires the extraction of materials required for manufacturing digital devices and expanding the transmission network (UNCTAD, 2024). They have implications for big data management and environmental footprint (United Nations, 2024).

2. Big Data

Trends and projections

Currently, the big data industry, worth USD 198 billion in 2020 (around 0.2 per cent of the value of global gross production), is set to proceed with rapid growth and should reach USD 684 billion by 2030,46 driven by the increased adoption of cloud computing, AI and the IoT, of which connected devices are expected to arrive at a stunning figure of 75 billion by 2025, with a value of EUR 5 trillion to 11 trillion. In addition, projections see the market for remote sensing and geospatial analytics rise from over USD 2 billion in 2018 to more than USD 8 billion by 2025 (FAO, 2022).

Implications

Growing digitisation is enabling Big Data. In the food systems, Big Data (BD) is being applied particularly in the context of consumer market research, precision agriculture, smart farming and digital farming. The most current or potential applications of BD in vegetables, fruits and other plant-based sectors include optimal planting of fruit trees using data extracted from satellite and unmanned aerial vehicle imagery (Saldana Ochoa and Guo, 2019), characterisation of size and shape phenotypes of horticultural crops using high throughput imagery (Haque et al., 2021), improvement of controlled environment agriculture, such as soilless hydroponics and others for vegetable and fruit farming (Ragaveena et al., 2021), and mitigating post-harvest losses and managing fruit and vegetable quality through machine learning (Singh et al., 2022).

BD technologies are expected to contribute to the optimization of farm production, minimization of disaster-related risks, reduction of costs of fertilizers application, more effective management of crop diseases and natural resources, mitigation of climate change and enhanced food security. But growing collection and use of BD also raise some concerns of unequal power dynamics monopolies, and challenges in ensuring transparency and accountability because a few players have come to dominate large shares of the market. Future growth in BD technologies will also potentially have positive GHG implications (FAO, 2022).

3. Artificial Intelligence

Trends

Most of the growth in big data analytics can be attributed to AI, specifically machine learning. The statistics on the use of AI in the food sector are not being published presently. But across various sectors, AI adoption is expected to grow at an annual growth rate of 37.3% between 2023 and 2030 (Forbes, 2024). At present, China is leading in AI adoption, with 58% of companies deploying AI and 30% considering integration. In comparison, the United States has a lower adoption rate, with 25% of companies using AI and 43% exploring its potential applications (IBM, 2024).

Implications

Currently, an AI revolution is happening in almost all industries including the agriculture and food industry on a global scale. There are two areas where AI is predicted to make a major contribution: improving nutrition and cellular agriculture. From expert systems and fuzzy logic to Adaptive Neuro-Fuzzy Inference Systems (ANFIS), Near-Infrared Reflectance Spectroscopy (NIRS), Computer Vision Systems (CVS), and AI-driven sensors, these technologies are transforming food production, quality control, and safety like never before. Compared with big data, these technologies have unique characteristics and application scenarios, and each plays a unique role in solving problems and optimizing processes (Ding et al. 2023). However, there are concerns related to AI taking over jobs causing loss of employment (UN Trade and Development, 2024).

4. Synthetic Biology

Trends

In December 2020, the first cell-based chicken nuggets were approved in Singapore. As of November 2021, there are at least 76 companies developing similar products around the world (Byrne, 2021). Many types of products and commodities such as various types of meat, poultry, fish, aquatic products, dairy and eggs are in the pipeline for future commercialization (FAO, 2022). Worldwide, Impossible Foods (a alternative protein producer) products are available in over 30,000 restaurants and 15,000 grocery stores (Christopher A. Voigt, 2020).

Implications

Developments in synthetic biology have enabled precision fermentation that allows microorganisms to be programmed to produce almost any complex organic molecule, including growth factors for the production of cell-based meat. Foods produced through advanced cell engineering are believed to be approximately ten times more efficient than a cow at converting feed into end products, translating to ten times less water, five times less energy and 100 times less land. Compared to a beef patty, the Impossible Burger requires 96% less land and 89% fewer greenhouse gases. Synthetic biology has revolutionised what we eat today and is expected to have positive implications on food security, health and climate outcomes.

5. Agronomic Innovation

Trends

Key trends include an increase in precision agriculture, which uses data-driven technologies such as drones, sensors, and GPS to optimise resource use, improve crop yields, and reduce environmental impacts. Another major trend is Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR) and genetic engineering, enabling the development of crops with greater resistance to pests, diseases, and climate stresses. Genetically modified seed market analysts project a sales growth of more than 5 percent per annum to reach a value of more than USD 30 billion by 2026 (FAO, 2017). Additionally, agroecology and sustainable farming practices like regenerative agriculture are gaining momentum by promoting biodiversity and soil health while minimising environmental harm. Innovations like vertical farming and controlled environment agriculture (CEA) are enabling year-round crop production in urban areas, reducing the need for large amounts of land and water. The increase in investment in agri-food technologies is driving these innovations.

Implications

Agronomic innovations are driving significant changes in global food production, helping address challenges like climate change and resource scarcity. A global and national focus on international research, subsidies and support for a few crop species (mainly high-value crops) has contributed to an overall decline in agrobiodiversity. There is a lack of research and innovation to support smallholders growing local and indigenous varieties of fruits and vegetables and other crops. There is a possibility that a lack of adaptive capacity and policy support will drive farmers to move away from diverse crops, further reducing the resilience of food systems by increasing the risk of crop loss from pests, disease and drought and the potential loss of Indigenous or local knowledge (FAO, 2022).

Important data sources

FAO Drivers and triggers for transformation report (2022) explains different terms and trends in global technological growth that are relevant for the global food system in detail.

Please email info@foresight4food.net if we are missing any data updates.